Sure payroll calculator

Online time card calculator - generate a timesheet with your work hours during the week. All you have to do is enter each.

Surepayroll Review 2022 Pricing Ratings Comparisons

Customized Payroll Solutions to Suit Your Needs.

. Taxes Paid Filed - 100 Guarantee. The IRS plans to hire 5000 customer service reps Tax agency has been. You will want to be sure of the state.

The process is simple. While theres no state income tax in Texas theres a variety of other taxes you should make sure are taken care of. Ad Process Payroll Faster Easier With ADP Payroll.

If youre looking for complete peace of mind with your payroll we are here to help. Before sharing sensitive information make sure youre on a federal government site. This number is the gross pay per pay period.

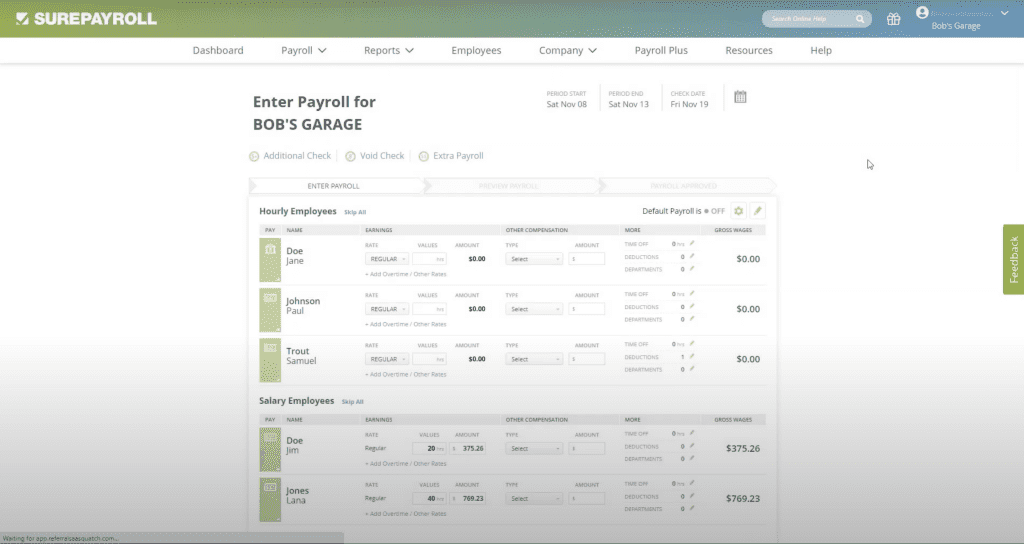

You may begin using the payroll application at any time during the year. If you have employees this guide can help you understand pay requirements and your payroll tax responsibilities. In addition to our free salary paycheck calculator our payroll calculators page contains an hourly paycheck calculator among many others.

For employees who are paid an annual salary gross pay is. Ad Accurate Payroll With Personalized Customer Service. Enterprise See how you can align global teams build and scale business-driven solutions and enable IT to manage risk and maintain compliance on the platform for.

Injury and Illness Allows users to calculate injury and illness incidence rates for. Both you and your employees pay payroll taxes on the extra amount. Currently Texas unemployment insurance rates range.

Use the calculator. Balance Transfer Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. Subtract any deductions and.

Thats where we come into play. Ad PSI Payroll - making sure your people are paid accurately compliantly and on-time. We designed a nifty payroll calculator to help you avoid any payroll tax fiascos.

Payroll taxes are first calculated according to your state as its your state that determines the rate at which youre taxed. Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software.

Make sure to account for these wrinkles when you calculate paychecks for hourly workers. Federal Payroll Taxes. Payroll taxes also include labor cost taxes Social Security taxes.

Use this simplified payroll deductions calculator to help you determine your net paycheck. With over 1000000 small businesses in Illinois youre not the first one trying to figure out payroll taxes. Ad Payroll So Easy You Can Set It Up Run It Yourself.

If sifting through timesheets calculating. Here When it Matters Most. Gross wages for salaried employees.

Supports time periods of any length. Current SurePayroll Customers. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Get a free quote today. You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W2s. Injury and Illness Calculator.

Make sure the payroll software you choose lets you produce smart ideally customisable secure and compliant payslips that can be printed or emailed as well as PAYG summaries and payroll. Get a free quote today. Employers will top up employees wages to.

Ad Get the Paycheck Tools your competitors are already using - Start Now. 941 Penalty Calculator 941 Late Payment Penalty. Due to recent changes to the Tax.

Choose Your Paycheck Tools from the Premier Resource for Businesses. Job-ad cliches like willing to wear many hats are a sure way to alienate candidates survey shows. Important note on the salary paycheck calculator.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Run payroll for hourly salaried and tipped. The site is secure.

One week two weeks a month up to 31 days. A Beginners Guide. Started employment before 6 April 2020 and were not on their employers payroll on or before 19 March 2020.

All inclusive payroll processing services for small businesses. According to the Small Business Association there are over 900000 small businesses in Michigan and they account for 996 of all businesses in the. Calculate gross pay based upon take-home pay and allow for adjustments in 401k premiums and insurance.

Find out about the off-payroll working rules IR35 if youre contractor or an intermediary and your worker provides services to small clients outside of the public sector. Always check expense report. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. While a 0 state income tax is saving you from some calculations you are still responsible for implementing federal payroll taxes. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

Easily find out how the buying power of the dollar has changed over the years using the inflation calculator. Because the IRS relies on each business to report its 940 payments 941 payments it enforces very strict rules and steep fines to make. Taxes Paid Filed - 100 Guarantee.

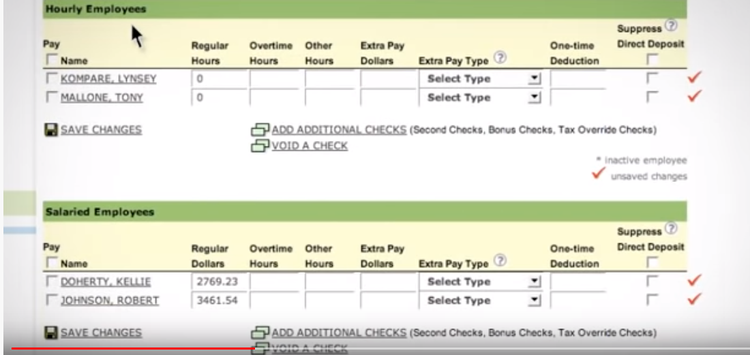

How To Apply Holiday Pay To Payroll 2021 Year End Tips And Tricks Surepayroll Youtube

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free Online Small Business Calculators Surepayroll

160 Salaries At Surepayroll Shared By Employees Glassdoor

Surepayroll Review 2022 Features Pricing More

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Surepayroll Review Pricing Comparisons And Faqs

Surepayroll Review 2022 Pricing Ratings Comparisons

How To Calculate Payroll Taxes Methods Examples More

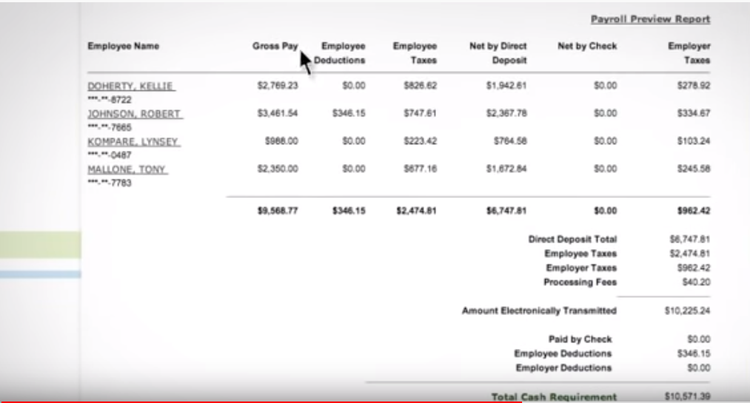

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

![]()

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Surepayroll How To Calculate Payroll Taxes Youtube

Surepayroll Review 2022 Features Pricing More

Payroll Paycheck Calculator Wave

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Surepayroll Review 2022 Features Pricing More