Gross income calculator yearly

To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

Annual Income Definition Calculation And Quiz Business Terms

Now divide your debt 1635 by your gross monthly income 4000.

. Please specify your yearly or monthly gross income. Gross income is money before taxationYou can read more about it in the gross to net calculator. 32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses.

Tips for using the Tax Form Calculator. Youll land on a page with an online salary tax calculator. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions.

Gross Yearly Earned Income Tax Credit. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. The first four fields serve as a gross annual income calculator.

Principal interest taxes and. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. Once youve calculated your Gross Operating Income and Operating Costs you will be able to subtract your running costs ie.

If you earn 65000 in a year you will take home 46094 leaving you with a net income of 3841 every month. Now lets see more details about how weve gotten this monthly take-home sum of 3841 after extracting your tax and NI from. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases.

Example of Annual Income Calculator. This is based on Income Tax National Insurance and Student Loan information from April 2022. If you have sources of income other than a salary ask your lender if they will.

PMI is a yearly fee that usually costs 1 of the total loan value. The general rule is that you can afford a mortgage that is 2x to 25x your gross income. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator.

Assume that Sally earns 2500 per hour at her job. This is a break-down of how your after tax take-home pay is calculated on your 65000 yearly income. Enter your grossnet wage here.

There is no consideration for any. 305 of the Gross Wage will be paid by the employee and by the employer together half by half. Gross Revenue Reporting.

However the national income equation includes the effect of inflation. The taxes and deductions are calculated according to the income. The result in the fourth field will be your gross annual income.

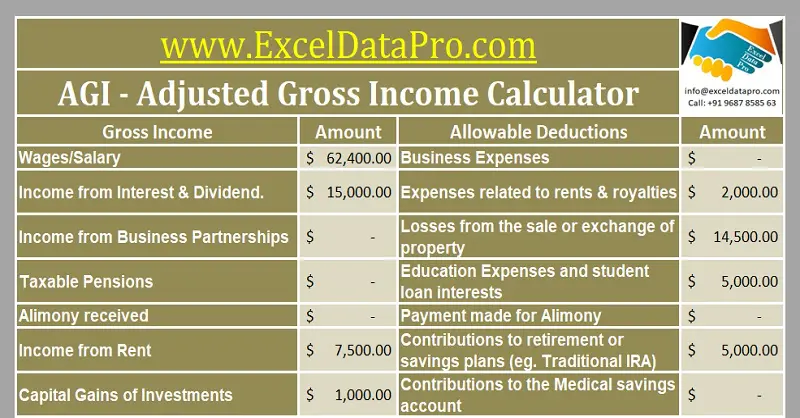

Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on. Operating Expenses from the yearly rental income earned ie. AGI is calculated when individual US.

1635 4000 40875. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE. Yearly Federal Tax Calculator 202223.

Urban High School Student. Income tax calculator 2022-23 Pakistan or Salary Tax Calculator 2022 and youll come across many search-relevant results. Taxpayers and households use the IRS form 1040 to calculate and file their yearly taxes.

Your gross salary income in Pakistan includes your basic pay and other allowances. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example. Use our simple NOI calculator above or do your own NOI calculation using the following formula.

All you have to do is enter your monthly income into our home-buying calculator to instantly get a home price that fits your budget. Button and the table on the right will display the information you requested from the tax calculator. How to use our Tax Calculator.

On your 1040 your business income and loss is calculated on Schedule C. This value should be the total of the household income if you are buying the property with a partner. You just converted your hourly wage to your yearly salary.

Lets work through how to calculate the yearly figure by using a simple example. AGI has several uses. 2022 tax refund calculator with Federal tax medicare and social security tax allowances.

Click any one of the displayed options of results. Math Behind the Salary Calculator. If you have a net gain from your business it counts as ordinary income.

Your refunds total 1000 leaving you with 19000 in sales. The calculator also determines the employers contributions which comprise pension insurance unemployment insurance health insurance and contributions for additional care provisions. You can calculate your net business income by subtracting your qualified business expenses including materials tools and labor costs from your gross earnings.

The amount of Care Insurance will be reduced for employees having a child. AGI calculator or adjusted gross income calculator is a tool to estimate your adjusted gross income AGI. If you have a net gain from your business it counts as ordinary income.

When gross revenue also known as gross sales is recorded all income from a sale is accounted for on the income statement. Comparison of Education Advancement Opportunities for Low-Income Rural vs. 65000 After Tax Explained.

If you get rid of the 85 monthly credit card payment for. What is an Income Tax Calculator. You can calculate your net business income by subtracting your qualified business expenses including materials tools and labor costs from your gross earnings.

It is a broader version of the gross domestic product as it also includes foreign production by national residents and excludes any domestic production by non-local residents. An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimesThe calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual. Either the monthly or yearly amount can be.

If you want to learn more about taxes and other levies paid in Poland check out our other calculators. This was exactly what I needed. The most common uses are to determine.

Thank you so much. On your 1040 your business income and loss is calculated on Schedule C. Polish salary 1 yearly - see what is happening with your salary month by month the calculator supports both an employment contract a specific task contract and a job order contract Polish earnings 2 taxno tax - simple conversion between gross and net.

By rounding up your DTI is 41 percent. 1 Do not include yourself or your spouse. Total monthly mortgage payments are typically made up of four components.

For a gross income example lets assume that after you go over your accounts you find your gross receipts for the year equal 20000. Whether yearly or quarterly. Gross Operating Income.

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

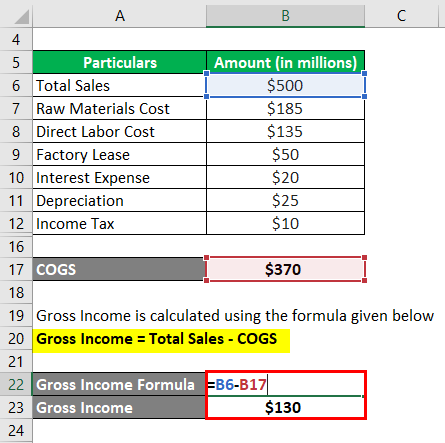

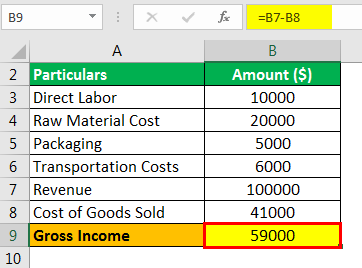

Gross Income Formula Calculator Examples With Excel Template

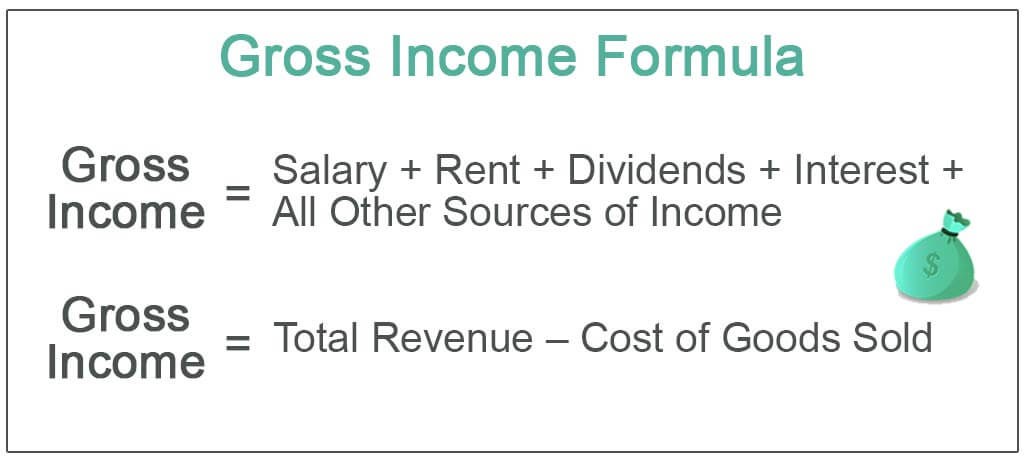

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Calculating 1 3 Of Your Income

Annual Income Calculator

Monthly Gross Income Calculator Freeandclear

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

4 Ways To Calculate Annual Salary Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Formula Calculator Examples With Excel Template

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

How To Calculate How Much You Need To Earn

Annual Income Formula And Gross Earnings Calculator Excel Template

How To Calculate Gross Income Per Month